Take the original investment amount 10000 and divide it by the new number of shares you hold 2000 shares to arrive at the new per-share cost basis 100002000 5. Stock Average Calculator helps you to calculate the average share price you paid for a stock.

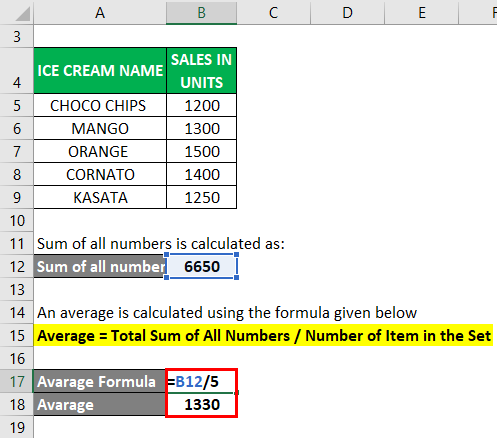

Average Formula How To Calculate Average Calculator Excel Template

Stock exchange and supported by Alpha Vantage.

. Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. Calculate your ROI by using the stock profitloss calculator to determine your percentage rate of return. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. Volume 0 300000 500000. Then find the cost basis for your total investment ie all fees and commissions you paid to both buy and sell.

Divide the total amount invested by the total shares bought. But you still have to add the total charges incurred. Ad Explore the Latest Features Tools to Become a More Strategic Trader.

The answer is to do some AVERAGING if the old average price is much higher than the new average price then it is a good buy since you are averaging down your stock price. Divide that amount by the 200 shares you now own and your average cost per share drops to 1750 down from the original 25. Stocks Under 1 2 5 10.

Even though the last share price 20 is lower than the original share price 25 your total investments market value is still higher than your purchase amount 16060 compared to 150. Enter the purchase price per share the selling price per share. For example suppose you buy 100 shares at 50 per share for a total of 5000.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. I want to buy 100 additional shares at 800 per share. Stock Average Price Total Amount Total Shares.

How is stock price calculated. The COLFinancial Buy and Sell Calculator is for you. Download Average Down Calculator as an Excel File for free.

Exchanges are also supported. For example 1 when we have valued stock at a lower cost or a Market Price of 1000 the Gross Profit is 1500 whereas in example 2 when we have valued stock at a higher cost or a Market Price of 1200 the Gross Profit Gross Profit Gross Profit shows the earnings of the business entity from its core business activity ie. Averaging down is an investment strategy that involves buying more shares of a stock when its price declines which lowers the average cost per share.

Subtract the cost basis of your investments from the proceeds derived from your stock sales to find your total stock profits. Then the stock drops to 40 per share. Finally the user gets the average down the price of the stock.

Backed By 30 Years Of Experience. To calculate your actual profits from a stock first calculate the amount you paid to purchase each stock. This application allows to calculate stock average on entering first and second buy details.

Cost Basis Average cost per share 4858 x of shares sold 5 24290. I own 100 shares of ABC stock at an avg. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts.

Enter the commission fees for buying and selling stocks. Disadvantages of Averaging Down. Take your previous.

Below is a PSE Calculator that Ive created to save you the trouble of. The average stock formula below shows you how to calculate. Stock average calculator calculates the average cost of your stocks when you purchase the same stock multiple times.

Your average cost per share is 1868. The average stock formula below shows you how to calculate the average price. To compute for the average price of the new stocks you just bought you have to compute for the total costs including charges and divide it by the total number of shares bought.

Its also known as dollar cost averaging 1. You can also figure out the average purchase price for each investment by dividing the amount invested by the shares bought at each. If you purchase the same stock multiple times enter each transaction separately.

I want to buy 100 additional shares at 800 per share. Calculator 13Average Down Calculator. Lower average cost stock calculator Monday April 11 2022 Edit.

This stock average calculator tool added all the shares bought differently divided by the total amount used to buy those stocks. If this investor had not averaged down when the stock declined to 40 the potential gain on the position when the stock is at 55 would amount to only 500. The profit of the company that is arrived after.

If you purchase the same stock multiple times enter each transaction separately. The difference between net proceeds of the sale and the cost basis in this example indicates a gain of 10710. Some stocks traded on non-US.

Average down calculator will give you the average cost for average down or average up. That would be 449000 pesos. If I buy more shares at a lower price what is my new average cost per share Determine Average Share Cost when adding share to existing position.

Averaging down can be an effecive stock market investing strategy when you believe the price will move higher. If you then bought an additional 100 shares of stock at 995 per share plus a 5 commission your total cost for all your shares would be 2500 plus 1000 or 3500. The charges are as follows.

Backtest dollar-cost averaged investments one-month intervals for any stock exchange-traded fund ETF and mutual fund listed on a major US. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. In my example I bought MEG at 449share for 1000 shares.

Cost Basis Average cost per share 4858 x of shares sold 5 24290. Be sure to take note of the following. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional Click on the Calculate button to estimate your profit or loss.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. Indexes are not supported. Smart Technology for Confident Trading.

You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. How much tax do I pay when I sell stock.

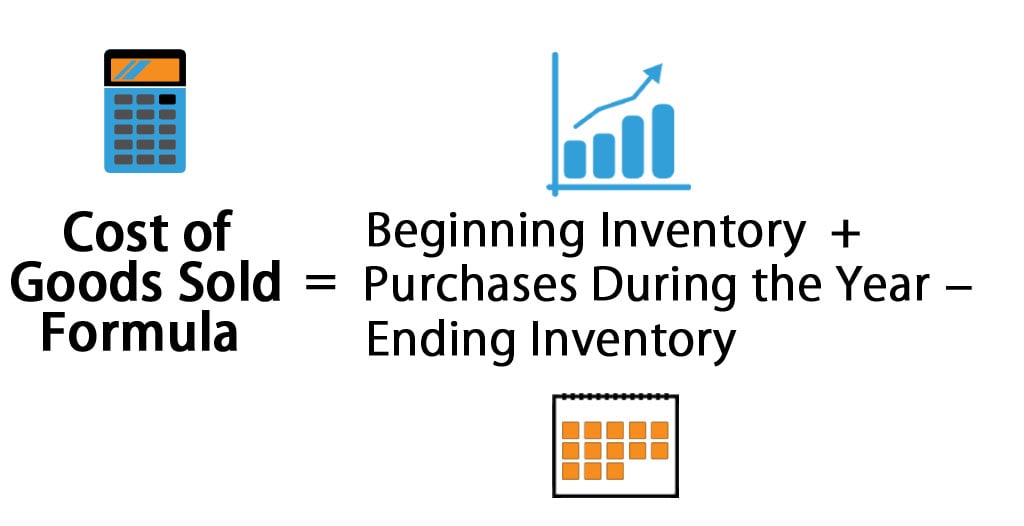

Cost Of Goods Sold Formula Calculator Excel Template

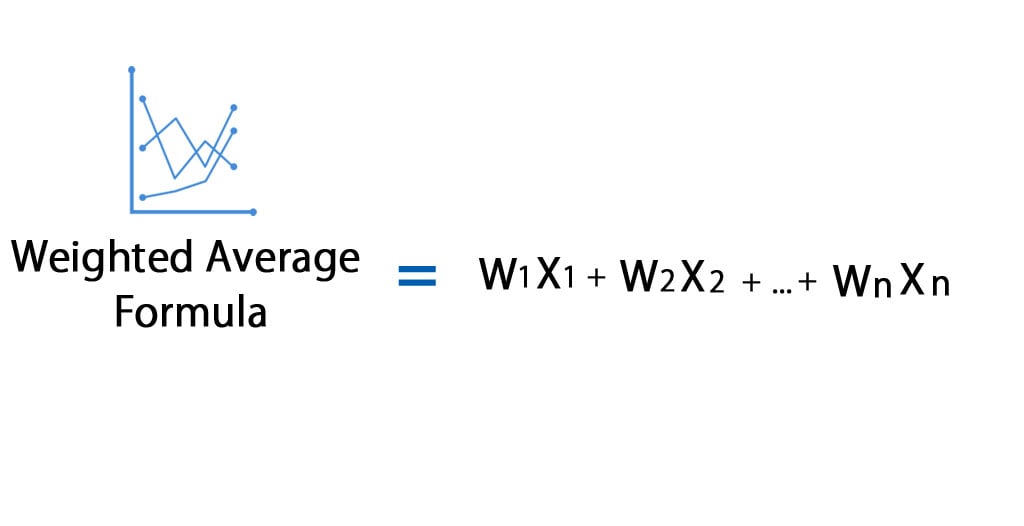

Weighted Average Formula Calculator Excel Template

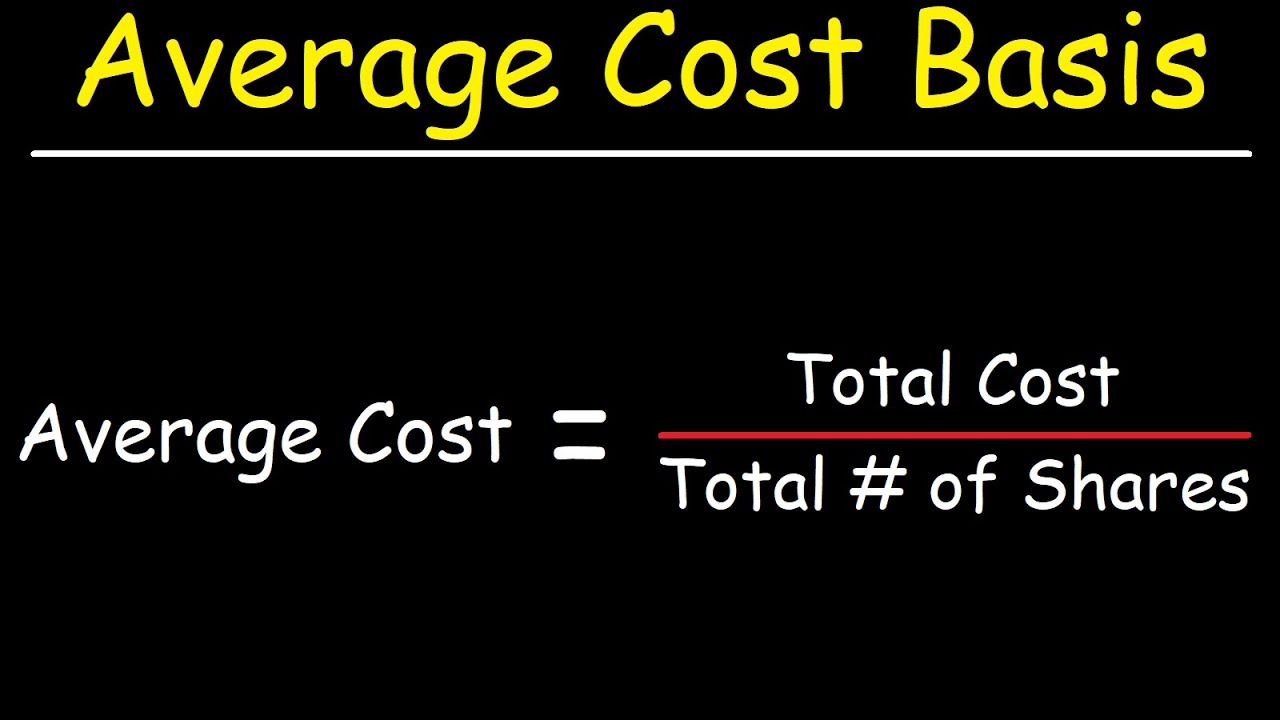

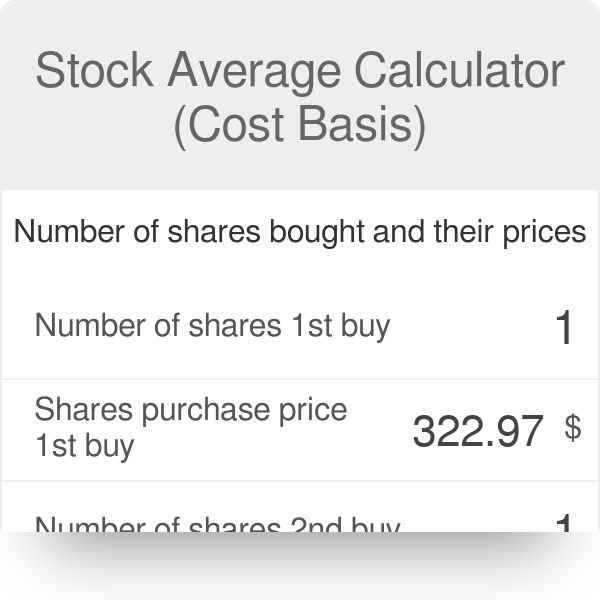

Stock Average Calculator Cost Basis

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

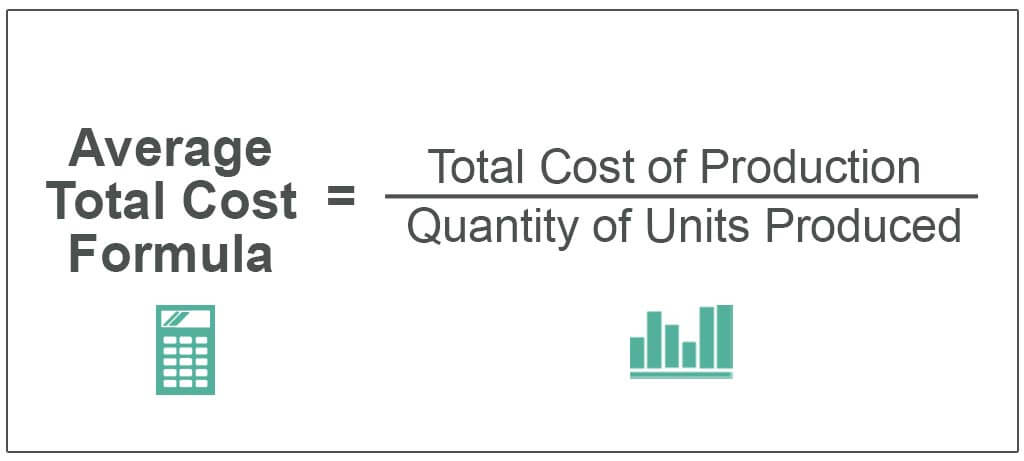

Average Total Cost Formula Step By Step Calculation

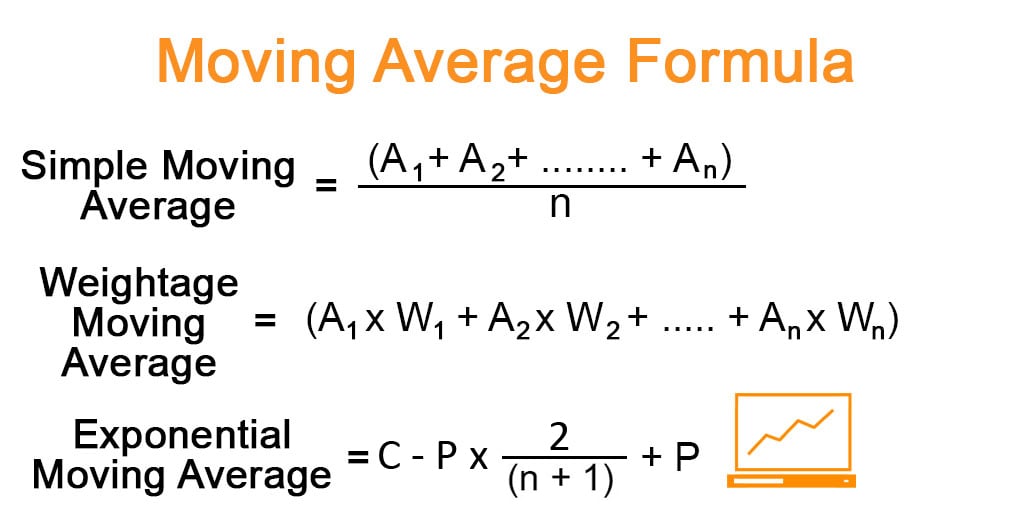

Moving Average Formula Calculator Examples With Excel Template

Cost Of Preferred Stock Rp Formula And Excel Calculator

Stock Average Calculator Cost Basis

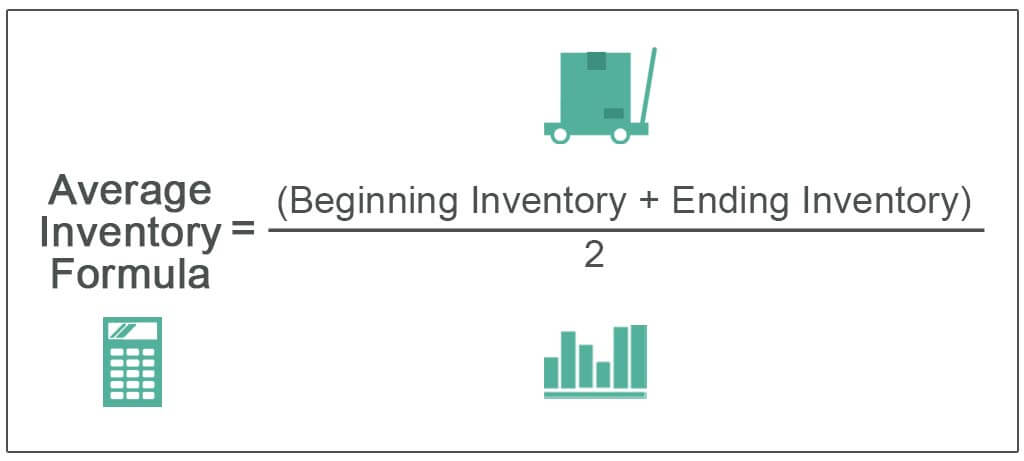

Average Inventory Formula How To Calculate With Examples

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Average Formula How To Calculate Average Calculator Excel Template

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

How To Calculate Weighted Average Price Per Share Fox Business

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)