An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. Arkansas Taxes Differ from Federal Taxes.

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

The top inheritance tax rate in any state is 18.

. There is no federal inheritance tax but there is a federal estate tax. Most states including Arkansas allow a surviving spouse and minor children to take an interest in the homestead of the decedent. Arkansas does not have an inheritance tax.

The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not. More distant relatives pay 13 for amounts over 15000 and. NoArkansas has neither an estate tax nor an inheritance tax.

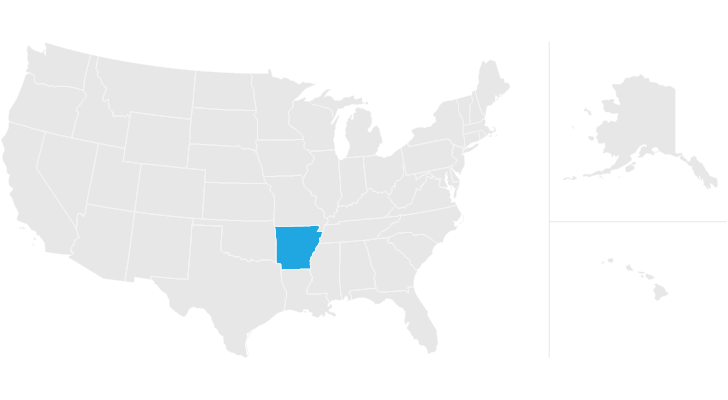

Arkansas also has no inheritance tax. It is one of 38 states that does not apply a tax at the state level. Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. The deceased person lived in a state that collects a state inheritance tax or owned. Arkansas does not collect inheritance tax.

Arkansas does not have an inheritance or estate tax. The State of Arkansas cannot tax your inheritance. There are only seven states that have an inheritance tax.

Arkansas also provides to the surviving spouse and minor. An executor can charge a reasonable fee for managing an estate in Arkansas. According to law they.

Non-relatives pay 18 on amounts over 10000. 600 E Market Searcy AR 72143 MLS 21034344 Redfin from. February 25 2021 By Milligan Law Offices.

Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who. If an Arkansas resident dies without a will his property passes to his surviving spouse and other heirs. However residents of Arkansas will.

Of those seven states Maryland and New Jersey are the only ones that have both types of state level taxes. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Inheritance and Estate Taxes.

Arkansas does not collect an estate tax or an inheritance tax. Thank you so much for allowing me to help you with your question. Does Arkansas Have An Inheritance Tax.

Inheritance tax of up to 18 percent. Arkansas law also requires a will to be written and attested by two witnesses. Up to 25 cash back parents siblings and other close relatives can inherit 40000 tax-free and pay just 1 of the market value of inherited property over that amount.

The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. While there arent any specific amounts or percentages for the fees they do have limits. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. However if you are inheriting property from another state that state may have an estate tax that applies. Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Inheritance Laws What You Should Know

Arkansas Inheritance Laws What You Should Know

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas State 2022 Taxes Forbes Advisor

How Do State And Local Sales Taxes Work Tax Policy Center

Is There An Inheritance Tax In Arkansas

Arkansas Inheritance Laws What You Should Know

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Historical Arkansas Tax Policy Information Ballotpedia

Arkansas Retirement Tax Friendliness Smartasset

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times